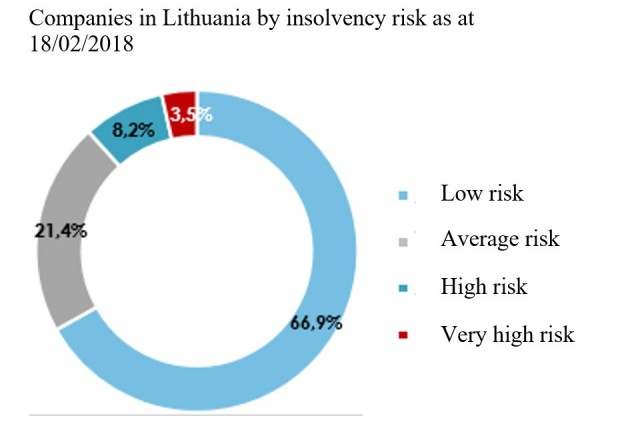

At the end of 2018, as compared to the same period in 2017, the number of insolvent undertakings decreased from 2,886 to 2,297 or by 20 per cent. In January of this year only, 165 insolvency proceedings of companies were initiated, however, in comparison to January 2018, this number is lower by 28 per cent. Evaluating the probability that the company will enter bankruptcy within 12 months, at the beginning of this year, Credit info allocated 67.4 per cent of enterprises to the low risk group and 11.2 per cent – to the high risk group. In the same period last year, this indicator amounted to 66.9 per cent and 11.7 per cent accordingly. Historically, such risk structure of undertakings demonstrates that the market is well balanced Creditinfo writes in a press release.

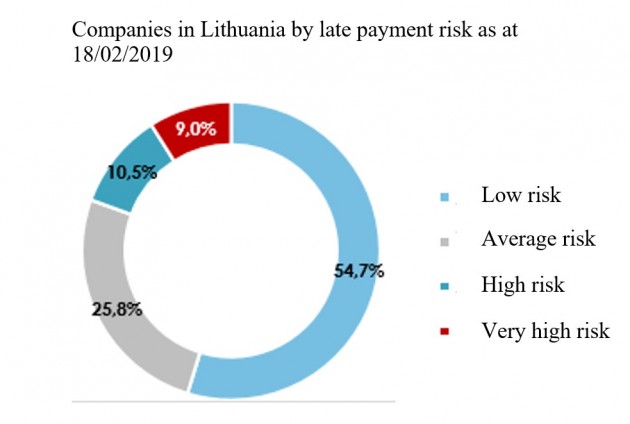

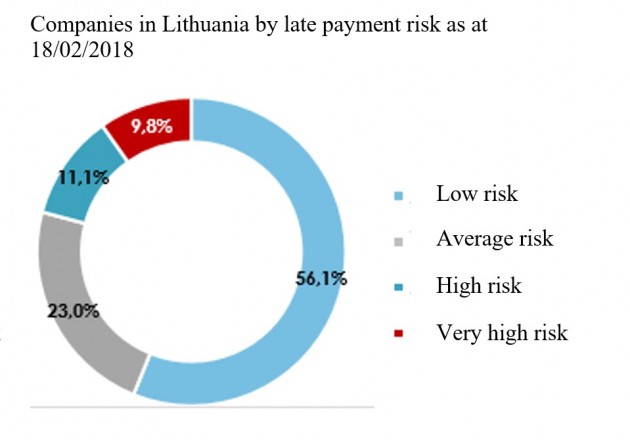

“The data available to us rebut the statements of certain analysts claiming that the negative signs indicating business challenges and possibly a decline were detectable already in the fourth quarter. To conclude, I dare to say that last year’s statistics are rather boring, with no obvious drama. On the other hand, certain worrying signs are detectable when comparing the late mutual payment rating – the number of low risk companies dropped within a year, while those of average risk increased. Moreover, it should not be overlooked that Lithuania has an open economy strongly dependant on export, therefore, any changes are nearly always determined by the external factors, which can be very unexpected,” said Rasa Ruseckaitė, Credit Risk Manager at Creditinfo.

According to her, the concern about the current geopolitical and economic changes has been reflected in the last year’s slight decrease of the Lithuanian undertakings’ willingness to borrow, however, this fact must be considered with reservations.

“Because last year, more borrowing agreements were concluded by the Lithuanian companies. The decrease of the total borrowings’ amount demonstrates lower volumes of borrowings, and the reasons for that can be very different,” she added.

Although, the analysis of individual sectors allows to identify the profiles of certain tendencies.

“The transport sector usually quickly responds to fundamental macroeconomic changes, however, last year, it was also focused on development – the volumes of the working capital borrowings grew by 24 per cent, with a 42 per cent increase in the volume of long-term borrowings. Meanwhile, the credit volumes in the construction sector shrank, with less working capital borrowings and long-term investments. The identical tendencies have been identified in the real estate segment. This corresponds to the message communicated by the players, stating that the market is saturated and the peak of growth has been reached. The number of the low late payment risk companies decreased and those of average risk increased both in the local and other segments. Actually, the assessment of the insolvency risk demonstrates that the situation in these business segments looks sufficiently stable – in the beginning of this year, 46.4 per cent of construction companies and 71.7 per cent of real estate enterprises were attributed to the low risk group, meaning that in a year’s time, this indicator hardly changed,” commented the Credit Risk Manager of Creditinfo.

Creditinfo used the data of more than 54,000 companies registered in Lithuania for the analysis performed.

More information: