Most likely household consumption was the main driver of economic growth in the second quarter, supported by strong wage growth and very low inflation. Meanwhile, net exports seem to have contributed negatively. Preliminary data show that the value of goods’ and services’ exports in the second quarter was by 0.3% smaller than a year ago, while imports rose by 3.5%. In the second half of the year export growth will also be challenging, as Russian economy continues to weaken and Latvian exporters face food products’ embargo by Russia. The direct effect of the latter is expected to be rather small though – banned products comprise only 0.5% of total Latvian goods’ exports. Yet, competition among food producers in Europe will increase and it will thus be more difficult to find other markets, even provided that demand in Europe will increase.

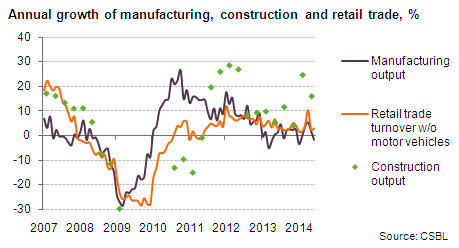

According to CSBL, construction grew by 16% in annual terms in the second quarter, retail trade by 4%, other services stayed flat, while industry still fell by 1% (since there was less heating and electricity produced due to warm winter without much snow). Given still strong construction growth, invesments most likely continued to grow in the second quarter, although imports of machinery and equipment were weak.

Outlook

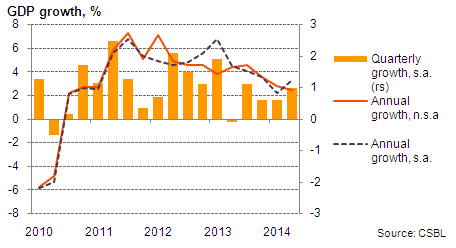

Economic growth this year most likely will be below 3% that we forecast in April. The main driver of growth will remain household consumption. Major risks to Latvian growth are still related to developments in Ukraine and Russia, and further possible sanctions to/from Russia.

In mid September CSBL will also revise historical GDP series, taking into account new ESA 2010 methodology, which might change GDP growth rates and levels somewhat.

Be the first to comment