The post-financial crisis period of 2010-2019 proved that the Baltic economies are able to cope and recover from large economic downturns successfully. During this period, the Baltics have seen growth in private capital manager’s activity, which in turn have given their fair share of contribution to the development of the region. Since the majority of capital raised is still available, it might bring hope for faster recovery of the current crisis too, Deloitte reported in a press release.

“Private equity partners can help to accelerate business development and get it ahead of the competition. However, letting in outside capital is not without its risks. This report will be very interesting to the managers and owners of the Baltic companies who are considering this option as a tool to deliver ambitious development plans. It includes several classifications of locally available private equity and venture capital firms as well as key trends in the Baltics private equity and venture capital market. I believe that information presented in this report will be an impulse to many local entrepreneurs to discover this tremendous and jet relatively unexplored opportunity,” – says Project Manager Tomas Milašauskas from „Deloitte verslo konsultacijos“.

The Baltic Private Equity and Venture Capital market is growing:

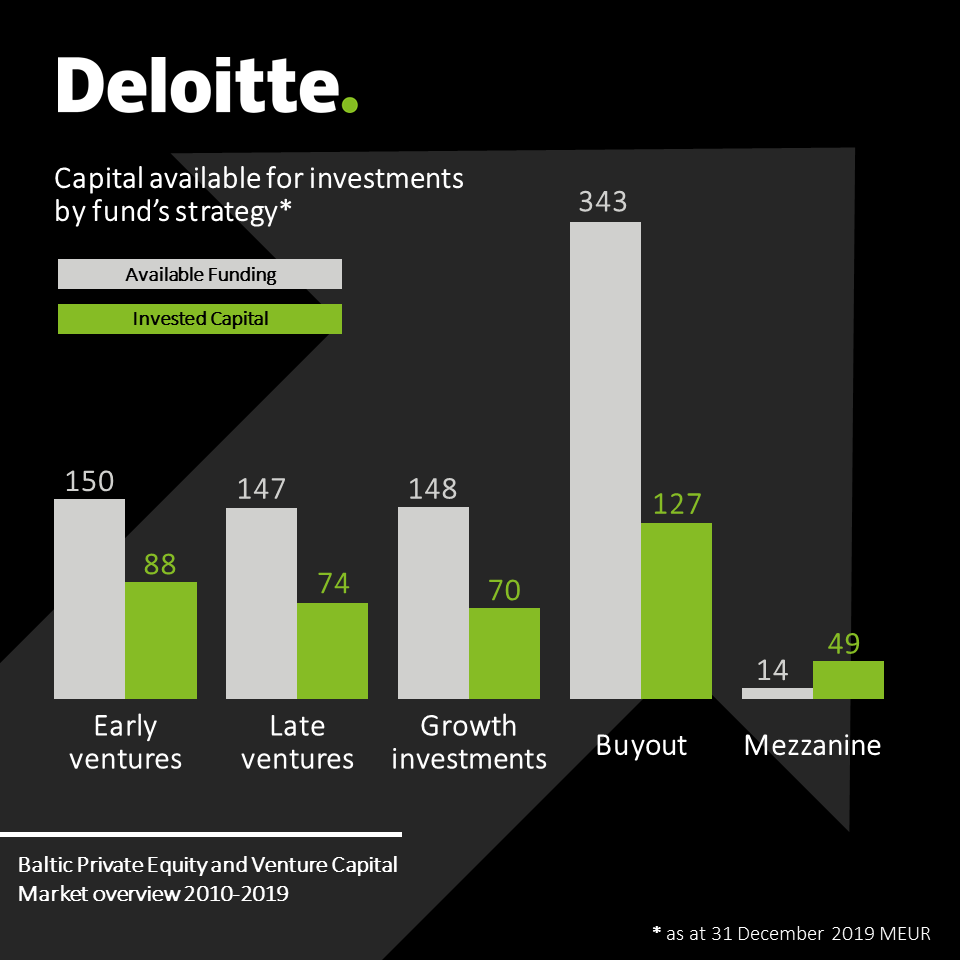

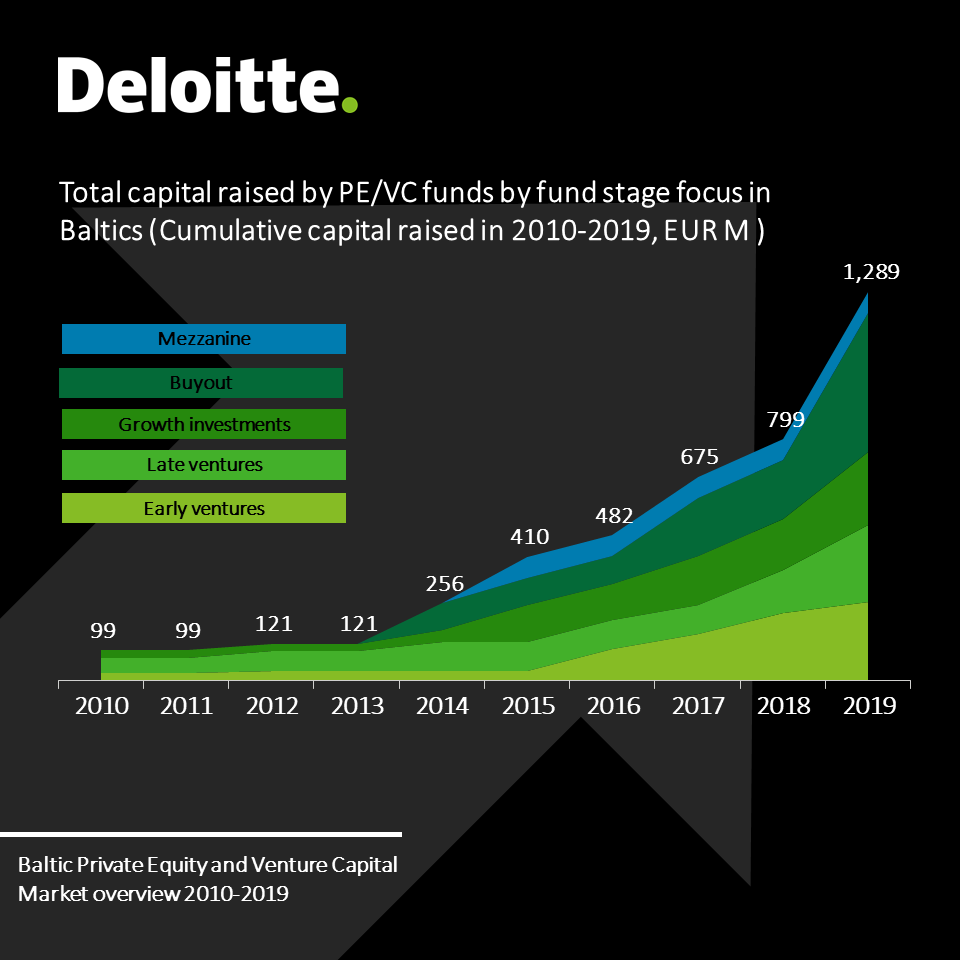

Since 2010 Baltic Private Equity and Venture Capital sector has demonstrated rapid growth with EUR 1.3 B of new capital raised, out of which about half (48.5%) was provided by government institutions and multilateral development banks. Till 2014, when funds had just started raising capital, 65.6% of funding came from public sources, but from 2015 onwards the share of private funding has been increasing and it reached 64.2% in 2019. 2019 was a record year with EUR 490 M raised, which is 4 times higher compared to amounts raised in 2018 (EUR 128M). The fact that the vintage of majority of funds is less than three years and that the majority of capital raised (EUR 800 M) is still available for investments sends a strong and positive message for businesses development opportunities across the Baltics and perhaps beyond.

The Baltic market is in the rapid development stage – 14 new funds commenced their activities in 2019 majority of which (8) with Pan Baltic focus, 5 – Lithuania focused funds, and 1 – Latvian focused fund. There were no new funds focused primarily in Estonia due to the lower number of government-funded early-stage venture capital funds and accelerators.

Largest amounts of capital raised (EUR 987 M was by the funds focused on whole Baltics as a region. Such funds tend to seek for a buyout (46.7% of capital raised) and growth investments (20.3% of capital raised) Meanwhile, funding raised by nationally focused funds amounted to EUR 37 M (Estonia), 117 M (Latvia), and 148 M (Lithuania) and concentrated on early and late ventures.

Two largest ever Baltics funds were raised in 2019 by INVL and BaltCap fund managers (EUR 142 M and EUR 126 M respectively).

Activity in investments is high, recently mostly in IT companies:

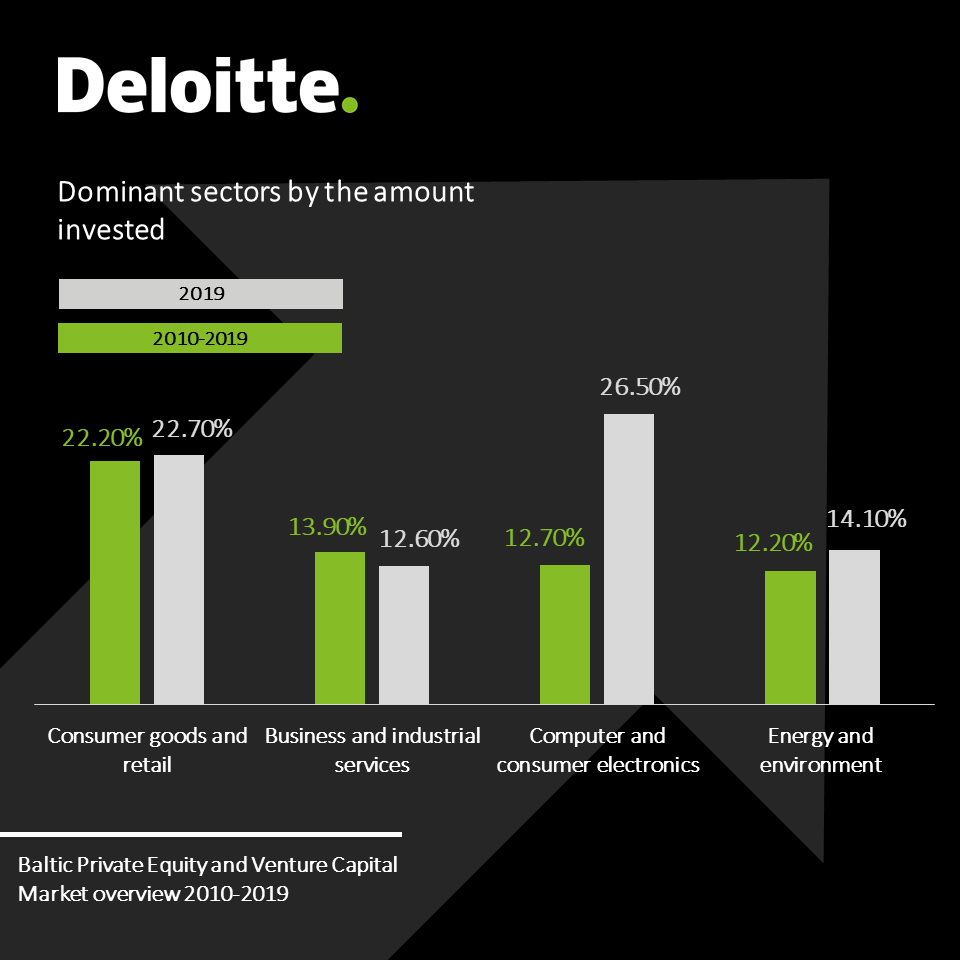

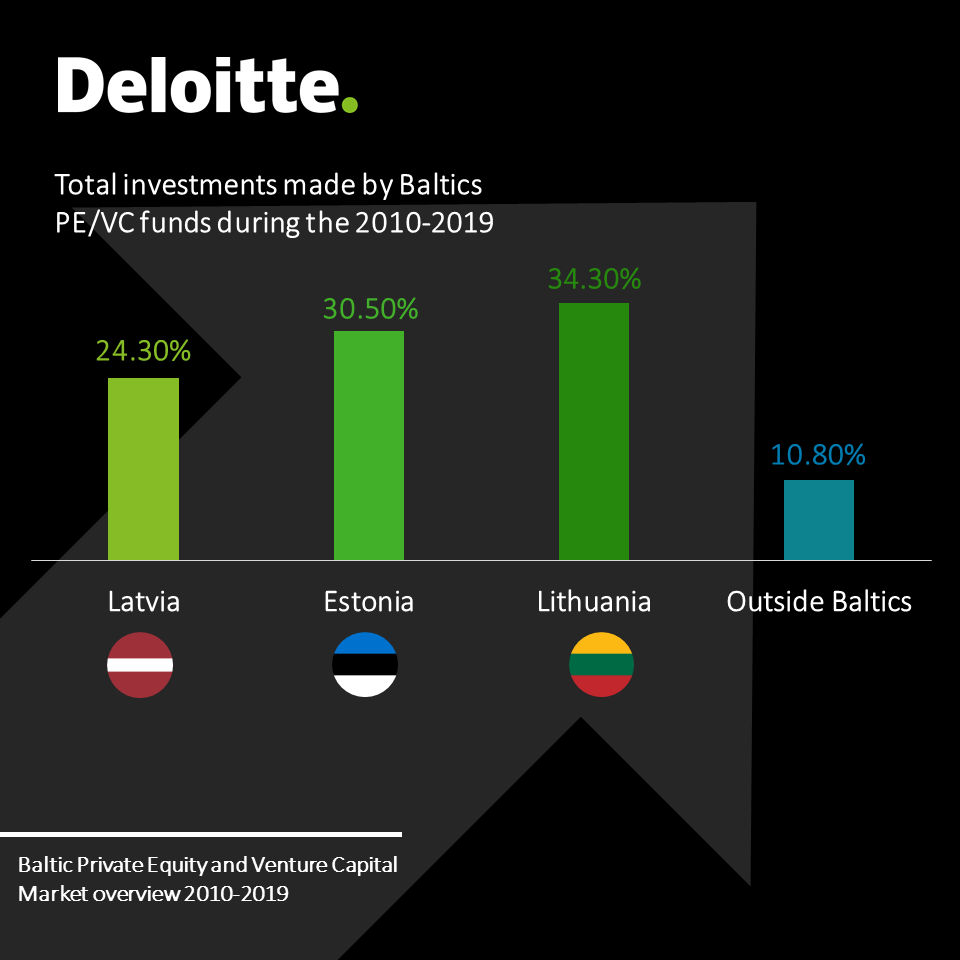

Funds’ activity in terms of performed investments was also very high with EUR 91 M invested in 2019, which is just slightly bellow of a record high annual investment amount observed in 2017 (EUR 96 M invested). Total investments made by Baltics PE/VC funds during 2010-2019 have been EUR 433 M, with the biggest proportion (34.3%) invested in Lithuanian companies.

Throughout 2010-2019 period, consumer goods and retail was by far the most popular investment sector with total of EUR 86 M invested. However, in 2019 with an increasing number of early stage venture capital funds focused on fast growing IT and internet companies – computer and consumer electronics sector companies attracted the highest amount EUR 24 M out of EUR 91 M total invested. Annual investment amount in Estonian and Lithuanian entities in 2019 was at record highs EUR 42 M committed into 46 companies and EUR 37 M committed into 74 companies respectively), while it was less active year for funds in Latvia EUR 13 M was invested into 74 companies.

In 2016 Baltic fund managers have also started to invest outside of Baltics (10.80% of total investments). As of the end of 2019 cumulative amount of EUR 47 M have been invested into 49 companies outside Baltics, majority of which concentrate in Scandinavian countries and UK. Number of divestments has been gradually growing and is expected to increase further in the upcoming years due to a number of funds reaching their termination year and thus, aiming to realize their investments.

For more detailed information, as well as data on each of the respective countries, view the Baltic Private Equity and Venture Capital Market overview 2010-2019 released recently by Deloitte here

Be the first to comment