At the beginning of June, the European Central Bank announced a 25-basis point (0.25%) reduction in the Euribor base rate. Analysts at the creative real estate projects’ development and placemaking company Citus calculate that housing affordability is improving, not so much because of the decrease in interest rates, but because of the recent wage growth. What do these developments mean for the housing markets in Lithuania’s major cities, and what should be expected next, Šarunas Tarutis of CITUS asks?

The dynamics of the housing market have been quite strong recently. Both supply and demand have become more ‘subdued’, and the factors influencing the market have changed. In May, developers added quite significantly to the supply of new housing. This is likely related to business expectations that the market will recover in the near future and that demand will increase. Wages have also been rising, banks’ interest margins on mortgages have been falling while the European Central Bank has cut the Euribor interest rate.

Šarūnas Tarutis, Head of Investment and Analysis at Citus: ‘This creates favourable conditions for buyers. This year, we have already witnessed a rather cautious increase in activity: in March, the demand was over 300 transactions per month, but in April, it was only 200, and the overall average for the year so far is only about 30 transactions higher than in 2022 or 2023. However, we can see that the consumer confidence indicator is increasing, now exceeding the level of the last two years. It shows that the preconditions for stronger demand are strengthening’.

Since the beginning of 2022, when the primary housing market in Lithuania slowed down, the demand for housing has remained. Fundamental factors during this time (economic growth in the medium and long term, increasing wages, employment health and the labour market) have remained unchanged. However, due to various reasons such as the inflation shock, more expensive financing and geopolitical reasons, people have taken more time to make their housing choices or even postponed the decision altogether, pending more favourable circumstances.

Tarutis emphasises that such powers have emerged. On the other hand, the accumulated unfulfilled demand – people who wish to purchase but do not purchase – is creating a waiting list that, according to preliminary estimates, is quite long, exceeding the current supply by 1–2 times.

He elaborates: ‘Housing affordability is gradually improving this year as wages are rising more rapidly than house prices, which have been stable for over a year. On the other hand, housing prices have slowly been growing by 14.59% in two years. Even if demand is low, prices cannot decrease due to the high and ever-increasing costs. In the last three years or so, there has been a vast number of new requirements for the development of projects, causing an increase in the costs. We know these requirements will only increase. Construction materials have not become cheaper, and wage increases have made construction labour more costly. Also, this is inevitable as Vilnius continues to expand and the whole country’s economy improves. However, with more affordable borrowing and the prospect of the Euribor continuing to decrease slowly, the overall situation is shifting in favour of buyers’.

The queue of people waiting for new housing would encircle Vilnius Old Town

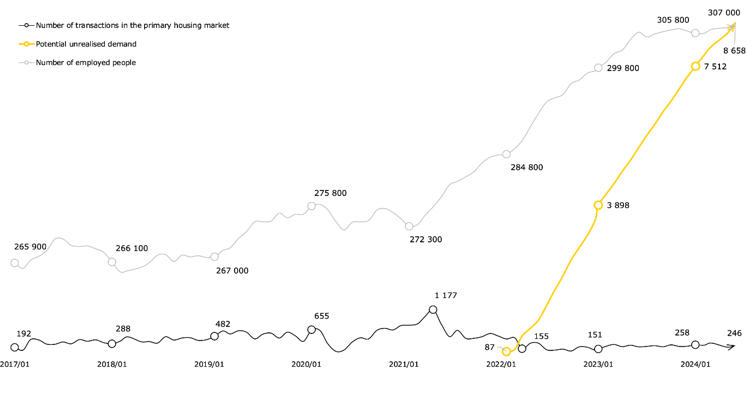

Citus analysts, based on long-term housing market statistics, estimate that up to 9,000 people may be waiting to buy a new home in Vilnius. For the purposes of the calculation, the number of transactions concluded each month from the beginning of 2017 to the end of 2021 was compared to the number of employed Vilnius residents – potential homebuyers – as provided by Sodra. This category also reflects the growth of the city’s population, which has been particularly significant over the last two years, amounting to as many as 27,000 inhabitants (the growth of the employed population was lower, at around 22,000). It also increases the potential demand for housing in the capital.

It has been assumed that in the long term, the number of those in employment and the number of primary market transactions are correlated, and the average coefficient of their relationship over the period 2017–2022 is estimated to be 0.175%. It implies that a population of 100,000 has a monthly demand for around 175 new dwellings, while the ‘normal’ monthly demand over the last 7.5 years, with population growth, should be in the range of 450–550 transactions. Therefore, at the beginning of 2022, the unrealised demand on the primary market was almost 300 units per month.

Tarutis continues: ‘According to our assessment, this is in line with long-term data. There have been different periods – more active and less active, which is natural. However, these dynamics are adjusted by various circumstances, and the balance remains similar. We can also see that while some factors are moving more significantly, such as wages and overall economic growth – and the coefficient should be increasing– the reduction in affordability restores equilibrium. This calculation cannot be exact, as some assumptions and factors cannot be estimated. Therefore, the waiting queue might be longer –around 10,000 buyers is very realistic. This number of people holding hands could encircle the Old Town’.

One of the assumptions that could reduce the number of prospective buyers is the secondary market. Prices there are generally lower than on the primary market. Additionally, most of the population will likely rent instead of owning a home. However, according to the statistics, secondary market activity has remained almost unchanged: it has been growing steadily since 2017 (as in the primary market) from around 575 to 795 units per month in 2021. With the slowdown in the primary market, the secondary market’s average increased by only 4.15% to 828 units per month in 2022 and then declined between 2023 and 2024, from 818 units per month last year to 740 units per month so far this year.

Tarutis explains this further: ‘This ‘attrition’ is highly insignificant for several reasons. First, demand has contracted not only in the primary market but also in the secondary market, albeit to a lesser extent. Second, prices in the secondary market are changing similarly to those in the primary market, meaning that no gap would absorb all the demand for housing. Third, with improving living standards and people’s expectations and needs for housing, there is an increasing desire for newer, new-build housing that aligns with the changed perception of living comfort. The rental market, for its part, is only a temporary solution, as supply is severely limited and prices have been high recently. Moreover, people are coming to realise that they are irretrievably losing money by spending it on renting rather than investing it in their own homes. Therefore, up to 5% of people can be subtracted from the number of people waiting for a new dwelling. The rest of the population will remain virtually unchanged’.

The ‘compressed spring’ effect and ‘fear of missing out’

Such a waiting list could take years to dissipate. Some individuals cannot afford to wait that long – as the size of the family grows, the available space may no longer be adequate for daily needs. As the size of the family becomes smaller, say, as children grow up and start to live on their own, it becomes expensive to maintain the extra rooms that are no longer in use. Finding a long-term solution for new residents moving to Vilnius can be even more difficult.

Tarutis: ‘We have already seen similar situations – the first year of the COVID-19 pandemic and the subsequent roller coaster ride in the American housing market. The worst thing is inertia, which both reduces and increases speed. For some time now, in my opinion, the falling demand is also the result of inertia: buyers are monitoring market activity, and now and then, they ask themselves, “Is it time for me to buy, or should I wait?” Psychology dictates that you have to trust the opinion of the majority, hence the protracted situation and tightening of the “spring”. However, at some point, with more activity and a critical mass forming the scales tip, and suddenly, everybody rushes to buy because of another paradox: the fear of missing out (FOMO). Then, in a relatively short time, we enter the opposite cycle – again driven by inertia – and the situation becomes out of balance’.

He emphasises that the correct information is essential for a wise, calculated, timely decision. He argues that recently, there have been more questions than answers about purchasing a home in the public domain:

Tarutis, Head of Investment and Analysis, concludes: ‘As I mentioned, the home buying conditions are now stable. Conditions are not particularly favourable, but it must be understood that the current circumstances will not create a “Christmas miracle” in the future. Property values in a developing economy and a modern, growing capital city will continue to increase, as will prices. I believe geopolitical uncertainty will remain a somewhat unsettling backdrop, but it will remain the same or even improve. In the housing market, we are already seeing the signals we started talking about 3–4 years ago: there are already the first examples of projects bought up by housing funds to rent them out. It significantly increases the competition among buyers, and the trend may become stronger if more people choose to rent rather than buy’.

So far, the situation is developing favourably. As Tarutis mentioned, the recent increase in housing supply in the capital aligns with ‘normal’ demand. This means it satisfies the actual demand for housing, but it exceeds the current demand and falls short when considering the unrealised demand in the primary market. However, part of this supply of around 1,000 dwellings is illiquid: it has been waiting for buyers for two years or more. Nevertheless, this buffer will help to rebalance house prices.

Developers and home sellers are also generous with various offers for buyers, and the financing situation has improved. This improvement is due to the fall in the Euribor and the banks’ lower interest rates on home loans. According to Tarutis, this aspect is essential for those buying a home with a mortgage: completed projects in the new housing supply, where buyers can immediately sign notarial contracts and obtain a loan, currently make up a relatively small portion. Whereas when buying a home in a project that will reach this phase later, the Euribor is expected to fall even further, making it easier for buyers to obtain financing.

Be the first to comment