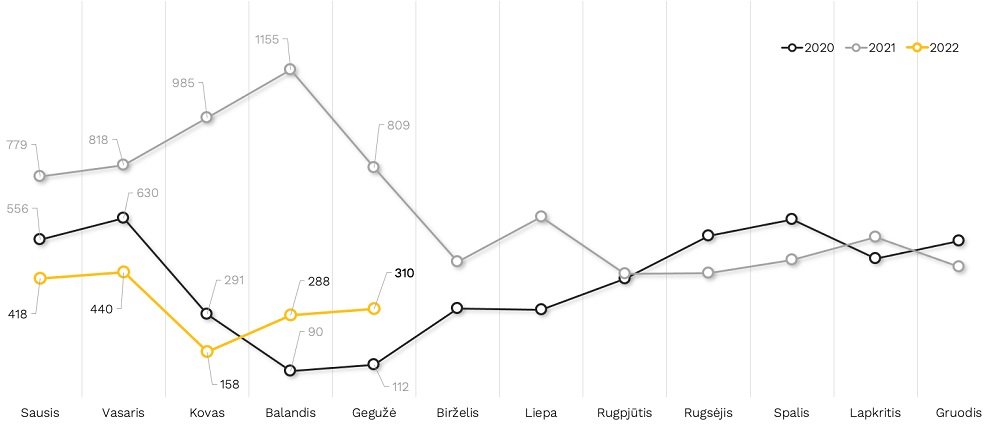

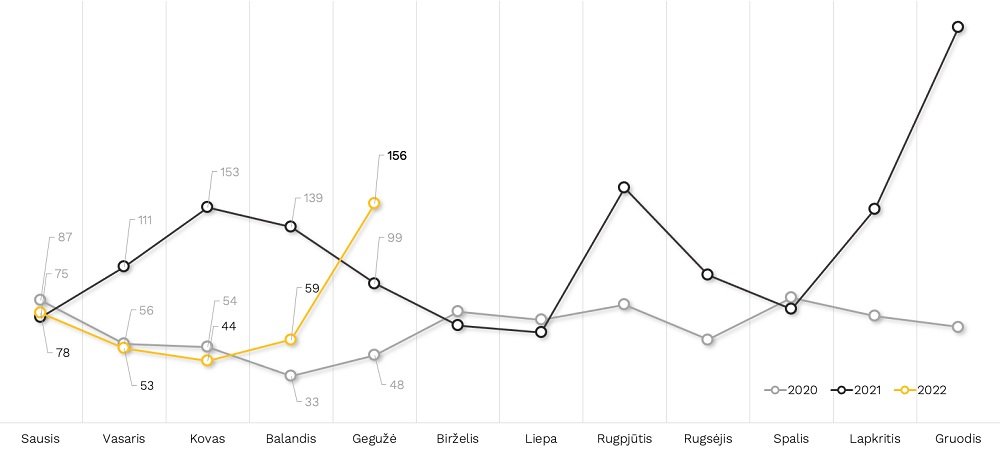

The last month of spring offered some surprises on the real estate market. Buyers decided not to wait for the end of the war in Ukraine and in May, the sales volumes continued to grow – 310 new apartments and terraced houses were agreed on in the capital and 156 in Kaunas. Buyers’ expectations are slowly returning, and some developers are rethinking their decision to stop construction, offering new projects to the market. Analysts at Citus see demand and supply recovering in the major cities but expect a third wave of house prices to come, driven by the still unpredictable rise in construction costs and the peak in inflation.

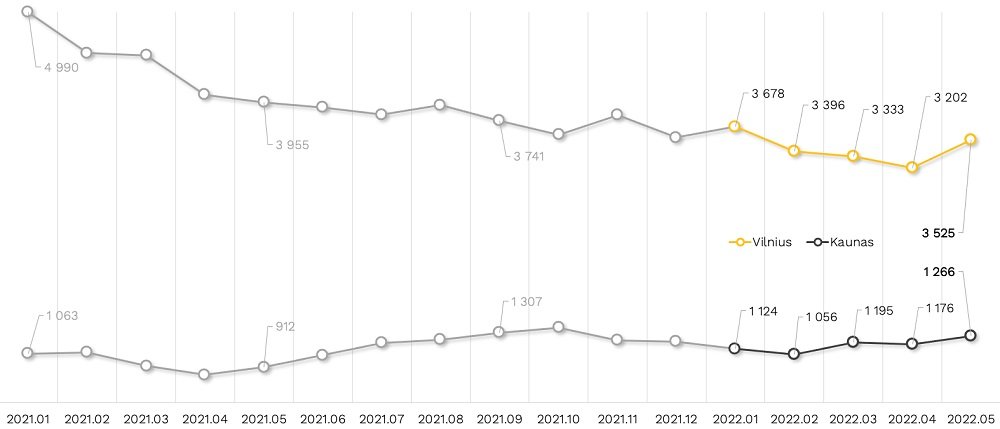

According to the preliminary data of Citus analysts, the average indicative price of new apartments on offer in Vilnius rose by 3.2% compared to April (EUR 3,024/sqm) to EUR 3,122/sqm. In Kaunas, the prices of new apartments on offer rose by 4.1% – in May, they reached EUR 2,212/sqm, while at the end of April, they were at EUR 2,124/sqm.

“Sales in the Vilnius housing market have not yet reached the pre-war levels, but they are already returning to the level observed a few years ago, when 300-400 sales were made per month. However, developers have provided surprises. In May, the supply grew by 323 homes – a 10% increase in supply compared to April. It has shrunk by 153 units or 4.1% since the start of the year, but is still far from the optimal level of around 4,500-5,000 units. Therefore, the increase in supply is still not compensating for the recovery in demand, which continues to put pressure on home prices. For this reason, authorities need to understand that long-term supply growth is crucial for housing affordability and must be encouraged rather than constrained by various additional measures,” says Šarūnas Tarutis, head of investment and analysis at Citus.

Chart 1: Dynamics of average supply prices in Vilnius and Kaunas housing markets in 2020-2022 (Citus data)

In terms of supply growth, the situation is not alleviated by the rising prices of building materials and contracting works. Since the beginning of the year, the price of contracting works on the market has risen by about 15%. The situation on the raw materials market is also tense, with prices of some materials being 200% higher, metals by 100%, and wood products by 100%.

Wages have risen and construction machinery has become more expensive. All this affects not only the price of housing but also the supply.

“The rise in the cost of building materials started a year ago. As the economy recovered and people around the world started to spend money, the demand for materials soared and all building materials started to be bought on the exchanges. The outbreak of the war in Ukraine, the rise in fuel prices and the refusal of Lithuanian businesses to buy building materials made in Belarus and Russia have all led to a second wave of construction costs. Although inflation is likely to peak soon, a third round of price rises is on the way, which will not only tighten supply but also reduce the affordability of housing for metropolitan residents,” says Tarutis.

In Vilnius, 310 new apartments and terraced houses were reserved in May, while 3,525 remained on offer. In the meantime, four new projects and five phases of previously started construction have been added to the stock, which amounts to 633 homes. In Citus-managed projects in the capital, 15 apartments and terraced houses have been agreed on in one month and buyers can still choose from 103 units.

Chart 2: Vilnius housing market dynamics in 2020-2022 (Citus data)

In Kaunas, according to Citus experts, 156 reservations for new homes (apartments and terraced houses) were made during the last month of spring, which is a record for this year and one of the best results in the last few years; 11 homes were reserved in projects managed by Citus. In the temporary capital, analysts recorded four new projects and two phases of previously started construction, adding 246 homes to the supply. At the end of May, buyers could choose from 1,266 homes, while only 21 homes were available in projects managed by Citus.

Chart 3: Kaunas housing market dynamics in 2020-2022 (data from Citus)

Citus experts calculate that there are not many cheap, economy segment homes left in both Vilnius and Kaunas: 1,284 in Vilnius and 549 in Kaunas. In the capital, the supply of mid-range housing is 1,901 units; the supply of prestige and luxury housing is 147 and 193, respectively. In Kaunas, the stock of mid-range housing consists of 527, prestige – 190; there are no luxury class projects in the temporary capital yet.

Chart 4: Supply dynamics in the housing markets of Vilnius and Kaunas in 2020-2022 (Citus data)

Be the first to comment