The COVID-19 recession was widely expected to be the worst global economic crisis since the Great Depression and much worse that the Great Recession of 2008-2009. It can still be, but recent economic data suggests that global economic contraction in 2020 will be smaller than feared, Luminor bank writes in a Spring 2020: Global economic outlook. What about the Baltic economies?

Firstly, the COVID-19 pandemic becomes increasingly less lethal, hence even countries experiencing a resurgence in COVID-19 cases are reluctant to re-introduce nationwide lockdown or other restrictive measures. As a result, even if there will be the “second wave” of COVID-19 pandemics in autumn/winter, the negative economic effect would be much smaller due to changed reaction of governments as well as households.

Secondly, unprecedented fiscal stimulus measures have kept economies afloat during the peak of the pandemic. Generous furlough schemes kept unemployment levels low, liquidity support for businesses prevented mass bankruptcies while household income support measures allowed private consumption in many countries to bounce back quickly once lockdown measures have been eased.

It remains to be seen what effect these measures will have on longer-term economic development due to distorted incentive system and record-high jump in public debt levels, but it is becoming increasingly evident that in many developed countries fiscal stimulus measures allowed to avert the worst of the economic crisis or at least to postpone it to the future.

Epidemics come and go, but economic stimulus stays, hence it is increasingly likely that in 2021 we will witness strong economic recovery, fueled by highly accommodative fiscal and monetary policies as well as receding COVID-19 fears. The Fed have recently announced changes in its inflation targeting regime, which suggests that interest rates might be stuck at zero for as far as 2025. This, in turn, would compel ECB and other major central banks to keep interest rates at or close to zero for many years to come.

Fiscal policy will likely remain accommodative as well, especially in the EU, which agreed to form 750 billion euro Recovery fund. Given these developments, the risk of post-COVID economic overheating and the formation of asset price bubbles should not be disregarded. Especially keeping in mind that similar developments were observed in Hong Kong back in 2003 after successful containment of SARS pandemic.

Yet the positive story is not shared by everyone, since COVID-19 recession is unique in a sense that it unevenly affects different countries, economic sectors, social groups and asset classes. Hence, the shape of the global recovery will be “K-shaped” (uneven recovery with increasing regional divergences) rather than “V-shaped” (sharp, but short decline, followed by fast recovery), “U-shaped” (sharp and longer decline, followed by more gradual, but rapid recovery) or “L-shaped” (sharp decline, followed by very slow and gradual recovery).

The “K-shaped” global recovery exposed vast regional differences. Southern Europe, Latin America and India were exceptionally strongly hit by COVID-19 recession and are recovering slowly, to a large extent following “L-shaped” recovery pattern. In contrast, Northern Europe, East Asia and Australasia regions were least affected and are experiencing “V”-shaped or even “J-shaped” (short decline followed by economic boom) recoveries, with some countries (e.g. China, Sweden) even managing to escape technical recessions altogether. Western Europe and Northern America are somewhere in between, principally following “U-shaped” recovery pattern. Hence, contrary to prevailing consensus, COVID-19 recession is affecting different countries unevenly thus increasing global economic divergence.

The “K-shaped” or multi-speed recovery is becoming omnipresent within the EU itself yet again exacerbating North-South divide. While presenting its Spring Forecasts, the European Commission expected fairly homogeneous recession in the EU: the difference between the largest (-9.7%) and the smallest (-4.3%) GDP drop was forecasted to be fairly small (5.4 p.p.). In its Summer Forecasts, the difference has been increased (to 6.6 p.p.), but the most recent data suggests that it will undoubtedly have to be increased further. For example, in 2020 Q2 the worst performers in the EU (Spain, France, Italy, Portugal and Greece) experienced 15-22% GDP contractions, while the best performers in the EU (Ireland, Lithuania, Finland, Estonia and Sweden) saw their GDP fall by a mere 3-7%.

Most recent data suggest that the North-South divide will persist, since tourism-dependent and highly indebted Southern European countries struggle to reignite their economies, while their Northern European counterparts already enjoy full swing recoveries. For example, retail trade growth in July was still below last-year levels in Italy, Spain, Portugal, Croatia, Slovenia, Malta and Bulgaria, whereas in the majority of Northern European countries it has already been above pre-crisis levels since May or June. Hence, the European Union (again) undergoes a multi-speed recovery with Northern European countries experiencing a “V-shaped” recovery, Western European – “U-shaped”, while Southern European – “L-shaped” recoveries. The risk is that widening North-South gap may increase political tensions, especially during the budget planning process for 2021 in autumn.

The “K-shaped” recovery is being driven by unprecedented sectoral changes. As a rule of thumb, economic recoveries are often being benchmarked to pre-crisis periods. But this time it should not be, since COVID-19 recession have permanently changed behavior of consumers and businesses alike. As a result, post-COVID economy will look different to pre-COVID economy or as the saying goes “one cannot step into the same river twice”.

Consequently, some economic sectors will never recover to pre-crisis levels due to structural changes that were accelerated by the pandemic. The most prominent ones are teleworking and e-commerce, which will permanently change the role and functioning of IT, real estate, trade, transport, travel, manufacturing and other sectors. Those countries that will adapt faster to these changes, will recover faster from the COVID-19 crisis. Whereas those that will lag behind, will find it hard to generate growth in post-COVID world. In this respect, North American and Northern European as well as East Asian countries have competitive advantage vis-à-vis other regions of the world, hence COVID-19 pandemics will likely increase global economic divergence.

The risk is that “K-shaped” recovery will increase income inequality within countries. Economic sectors that used to pay most generous salaries before COVID-recession (IT, finance, public sector) have suffered comparably less than those that used to pay lower salaries (leisure, travel, catering and other services), hence income inequality is likely to increase. Moreover, the recent boom in stock markets (and upcoming boom in real estate market?) fueled by unprecedented fiscal and monetary stimulus, will likely increase wealth inequality as well. Increasing income and wealth inequality may prompt governments to increase taxes and/or public spending (e.g. introduce universal basic income), which could permanently increase the role of governments in the economy.

K-shaped recovery is also visible in financial markets with stock prices diverging away from commodity prices. During the post-2009 crisis recovery, oil and metal prices increased faster than stock prices thus allowing Russia and other commodity-exporting countries to recover fast. This time, however, the situation has turned upside down. Global stock market index is already at pre-crisis levels, but commodities struggle to find momentum. These tendencies are expected to continue due to changed economic structure, fallen global trade and ambitious plans of the EU to reduce CO2 emissions (after all stone age ended not because of the lack of stones), hence economic divergence between the European Union and Russia will continue to increase.

“K-shaped” multi-speed European recovery

North-South European divide

The Baltic economies have joined the Northern European League

The United Nations has classified the Baltic States as Northern European countries back in 2017. Three years later the Baltic States proved that they rightly deserved this title by demonstrating Nordic-style resilience to COVID-19 recession. Indeed, the Baltic economies, together with other Northern European economies, were among the least affected in the EU.

During the first half of the year, the EU economy contracted by 8.3%, but Northern European economies fared much better dropping only by 2.9% and the Baltic ones – by a mere 3.1%. Hence, contrary to the 2008-2009 economic crisis, when Baltic economies were among the hardest hit in the EU, this time economic contraction will be among the lowest in the EU.

The Baltic resilience is a result of the effective management of COVID-19 health crisis and the absence of internal and external imbalances during the pre-crisis period. The Baltic states ranked among the top-5 OECD countries according to the new pilot index for the effectiveness of countries’ early response to COVID-19 (OECD, May 2020). The relatively low number of COVID-19 cases allowed to gradually ease quarantine measures already starting from mid-April, which in turn allowed the economic activity to recover faster than in the rest of the EU. Baltic states were also the first in the EU to open borders between each other already in mid-May (Baltic travel bubble). As a result, the majority of businesses have already fully re-opened their operations in May, which substantially limited overall economic drop in Q2 2020.

Baltic economies learned lessons of 2008-09 crisis

The Baltic countries have undergone severe adjustments of external and internal balances during the aftermath of the 2008-2009 global economic crisis, which increased their resilience to any external or internal adverse shocks. Moreover, economic structure has changed with the rapid expansion of high value-added service and high-tech manufacturing (machinery, electronics, chemicals and pharma) exports constituting an increasingly larger share of overall exports.

At the same time, dependency on Russia and other CIS countries have materially declined in the aftermath of the 2014-2015 Russian economic crisis, which motivated Baltic companies to strengthen the grip on Scandinavian and Western European markets. Finally, rigorous macroprudential policies helped to avoid real estate price bubbles and thus increased its resilience to COVID-19 recession.

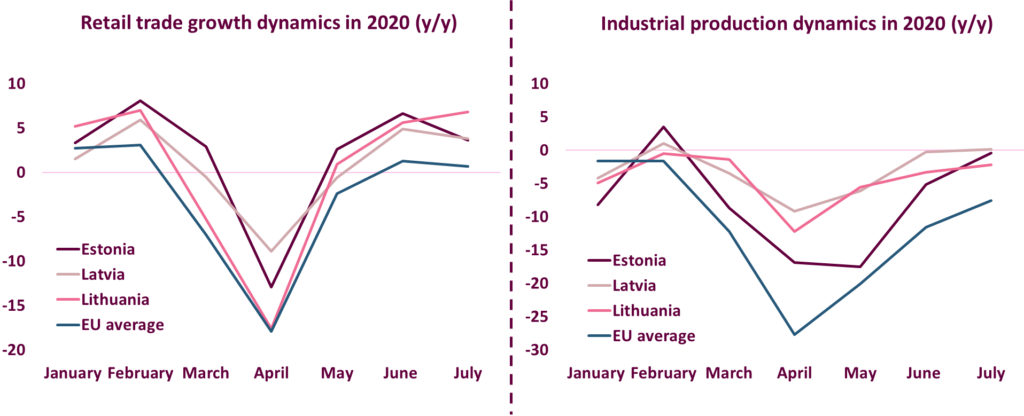

The most recent data suggests that economic recovery in all three Baltic States is well under way and is reminiscent to the “V-shaped” recovery i.e. sharp, but short drop, followed by robust and balanced recovery. Retail trade figures are especially strong, running well above last-year levels. Indeed, it can be called “C-shaped”, or Christmas-shaped, recovery, since retail trade activity in summer was reminiscent to pre-Christmas peak period.

Obviously, some of this bounce-back can be explained by a released pent-up demand, since people during the national lockdown were unable or unwilling to make planned purchases, but please note that in all three Baltic States overall retail trade turnover during the first seven months of the year (January-July) already exceed last-year levels (by ~1-2%). Industrial production is somewhat lagging behind, but it is also gradually recovering and has almost reached pre-crisis levels. Given that major export partners (Scandinavian countries, Germany and Poland) are doing relatively well, one could expect industrial production to reach pre-crisis levels already in autumn.

We forecast that Baltic economies will continue its robust “V-shaped” recovery with Lithuania and Estonia generating positive growth in 2020 as a whole. Hence, the COVID-19 recession will likely be the most severe, but at the same time – the shortest in Baltic history. In 2021 Baltic economies will get boost from continuous economic stimulus, influx of EU funds and fading COVID-19 pandemic fears, which would keep growth levels withing 4-5% range. Contrary to 1999 or 2009 crisis, this time Baltics will do much better than the EU average, hence Baltic GDP per capita (in PPP) will converge to 80-90% of EU average levels and will become similar to that of Spain or Italy.

Open and small Baltic economies remain exposed to any of the risks, which could negatively affect the resilience of the EU recovery. The biggest risk by far is uneven multi-speed “K-shaped” recovery, which may increase European North-South economical and political divide. The rising threat of the “second wave” of COVID-19 pandemics should not be disregarded either. Even though it is highly unlikely that nationwide quarantine measures will be re-implemented in Northern or Eastern European countries, the risk still remains that Southern (or even some Western) European countries may opt to re-introduce some of the measures if the pandemic situation would deteriorate further.

Moreover, the activity of some sectors such as international travel or aviation will remain depressed for some time to come (please see Appendix for our thoughts about the future course of the pandemic). Domestic challenges include still-elevated unemployment levels and uneven sectoral recovery, which would take years to resolve. Yet, at the same time, there are great opportunities coming with a record-high influx of EU money, which, if invested wisely, could facilitate economic transformation towards more digital and greener economies.

V-shaped” recovery in the Baltics

GDP forecast table of the Baltic economies (annual change, %)

Appendix: Our thoughts about the future course of the pandemic

We are not virusologists, but we need however explain our assumptions about the pandemic or our economic story would be incomplete.

Bill Gates who was prescient in predicting the risk of the pandemic says that it will be over until the end of 2021. That seems plausible. From economic point of view the most important question is not “when the pandemic will be over”, but – when it will cease to be a significant barrier to economic activity in systemically important countries.

That can happen well ahead of the complete eradication of the virus (it may be that the virus will not be eradicated at all and we will have to learn to live with it). This year there have been many unpleasant surprises, but also some pleasant ones. One of them is the development of the vaccine that is much faster than experts have forecasted at the beginning. Maybe there will be several technologically different vaccines.

We expect that mass vaccination will start around the turn of the year, but significant time will pass until all who want it will get it, due to production constraints. Health experts also warn that no vaccine will be a “perfect” solution – none of them will protect all recipients and/or will not protect them indefinitely and some people will refuse to use it. However, saving the world economy does not require a perfect vaccine. It is only necessary that people who use it – repeatedly if necessary, are sufficiently assured to be able to resume a normal life.

Even if the vaccine does not prevent sickness, only its more severe forms, it will be a significant gain. Any vaccine will be only one of risk reduction measures besides better drugs and better designed social distancing measures. That provides hope that during the next tourism season this sector will gradually normalize, though during the upcoming spring season the negative impact will probably still be felt.

We assume that during this autumn the “second wave” of the pandemic will continue in Europe with socializing and travelling restrictions continued to be in place. These will not be as draconian as in the spring of 2020, we do not expect freezing of industrial production, closure of non-food retail or restrictions on going out. Therefore, Baltic exports to these countries will not be significantly affected apart from tourism which is at a very low point anyway. The first wave in March was a big shock, it stopped international tourism, sharply cut industrial output through the effect on both production process and sales.

The Baltics will find it difficult to keep infection rates at the current low point. Nevertheless, even if detected infection levels will reach or even exceed the spring peak, as it has happened in several European countries, the damage to the economy will not be on the same level. The lack of knowledge encouraged steps that were excessive, but the positive role that social distancing and testing can play was under-appreciated. Now we know how to arrange social distancing measures with lesser pain and bigger gain. The lethality of the disease is declining – doctors are learning how to cure it, possibly also the virus is changing by becoming less virulent, following a strictly Darwinian logic.

Be the first to comment